Citi

Go-to-Market Strategy & Execution - Product Launch

Role: Product Marketing Lead | Deliverables: Primary/secondary research, 4C analysis, audience definition, key insight, creative brief, campaign strategy, channel roles, comms plan, A/B testing plan

Results: Delivered $3 billion incremental funds in 9 months

Challenge: Citi was launching its first digital-only banking product, a high-yield savings account (HYSA), in areas of the country where it had no physical branches. It needed to bring the product to market in ways that drove acquisition in a category dominated by superior competitive products.

Strategic Approach: Once I gained alignment on objectives and KPIs, I developed a strategic go-to-market plan and led cross-functional teams through execution. I divided work into 4 phases: research/insights, campaign, comms planning and experimentation.

Phase 1: Research & Insights

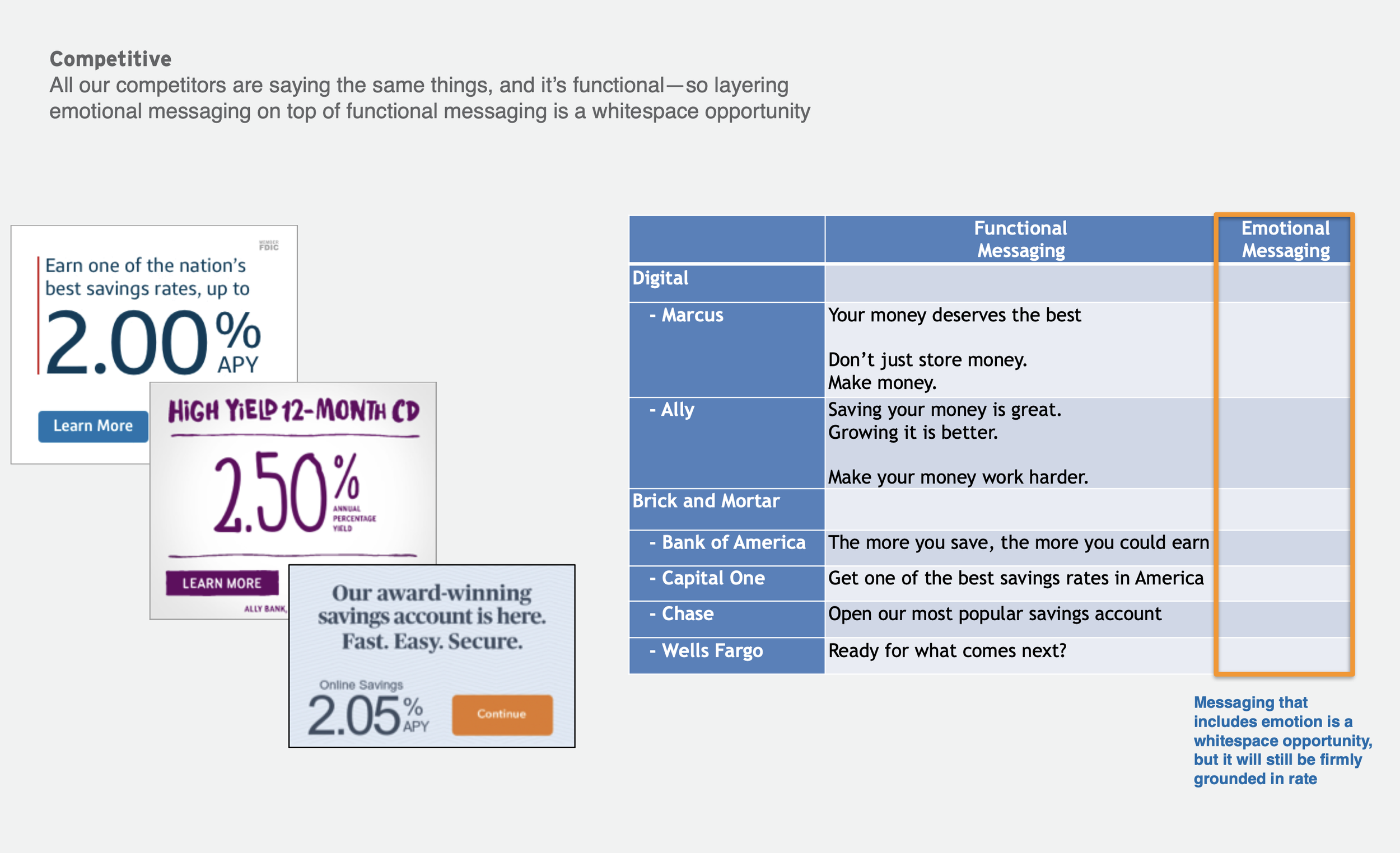

I conducted primary and secondary research as part of a 4C analysis (customer, culture, competition, company), uncovering 3 key insights:

Prospects had little awareness of Citi as a provider of banking products

Most banking messaging focused solely on functional benefits

Our audience was a group of savers doing silly things to save a buck or two

Work samples:

Phase 2: Campaign

When I uncovered the insight that our audience was doing silly things to save a few bucks - eating in the dark, cutting their own hair and using takeout packets to refill their ketchup bottles - I knew there was a simple but effective way to position Citi’s HYSA: the intelligent way to maximize your money.

This positioning served as the foundation of the creative brief I developed for the creative team, which I collaborated with from concepting through asset development. The team created the Save Smarter campaign to drive awareness by breaking through competitive clutter, infusing humor into a category dominated by functional messaging. You can see campaign creative here.

Phase 3: Comms Planning

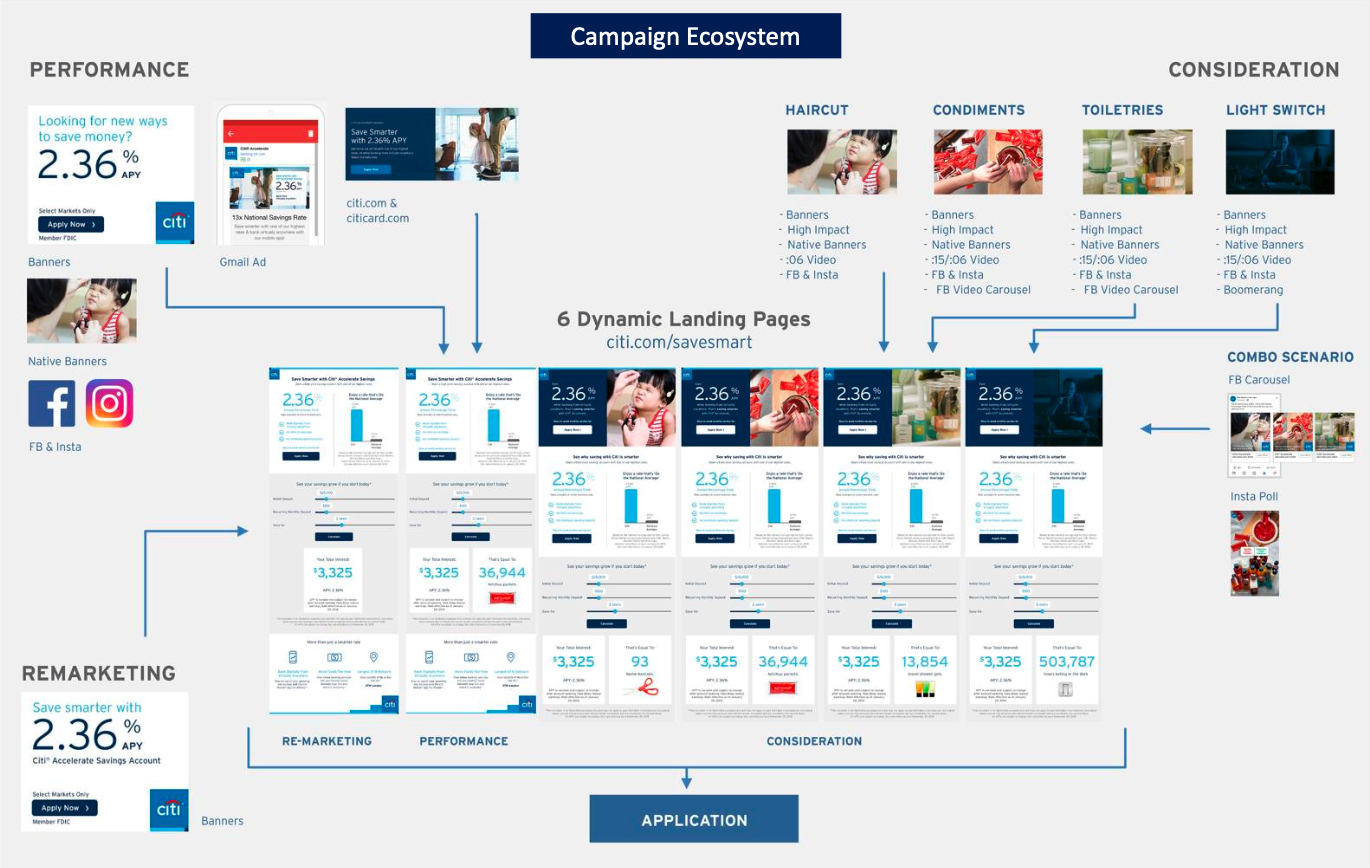

I developed an end-to-end campaign strategy the media team leveraged to create a digital media plan. I then translated creative into channel-optimized messaging throughout the campaign ecosystem to pull our audience through the funnel by communicating the right message at the time. Work samples: